Digital Signature are gaining popularity in banking and finance, and it isn’t just about convenience

The twenty-first century has seen some exceptional IT solutions, and the pandemic has simply paved the route to more disruptive breakthroughs that have enabled the world to move forward remotely through digitization. Today we are in an era where you can be in the comfort of your home or workspace and still get work done without spending hours traveling. However, some business activities still require manual work, and these are yet to go digital to complete the sustainable IT ecosystem.

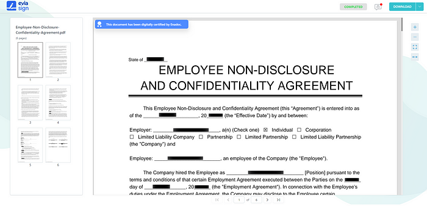

A signature is a significant element needed to complete a process or even just a fragment of it. It is most frequently required in multitudes on different places the document from various people, especially in places like banks and other financial institutions, that necessitates secure, timely signatures.

Today most banks and financial institutions are following the digital route by taking a paradigm shift to remote services, where most of the crucial activities, such as management of accounts, viewing transaction history, paying bills, transferring money, and accessing other banking services, are completed via online or mobile banking. However, even amid this digital game, still there are some portions of the banking activities yet to go digital — signing documents.

This blog will uncover some of the scenarios on how incorporating electronic documents and digital signatures can benefit banking institutions.

Introduction

E-signatures are gaining popularity in banking and finance, and it isn’t just about convenience. In addition to the typical benefits like productivity, efficiency, and time convenience, security and compliance are the two most important elements in a banking environment; one is to make sure that the confidential documents sent into and out of the institutions are safe, and the other is to meet the standards.

Both of these are resolved with Evia Sign, a digital signature solution that provides higher levels of security and compliance through authentication and compliant digital certification. Additionally, Evia Sign e-signature solution can cut down days worth of work to be finished in a matter of hours and substantially lower the cost of paper and other materials, paving the way to green banking.

Core areas where Evia Sign can complete the digital ecosystem of banking and other financial institutions.

Customer onboarding and account opening

How would you consider if customers could join your bank and open an account without involving in-branch presence, wait for a long time, or need paper-based signatures?

Giving the consumer a seamless experience is essential because this is one of the instances where the customer relationship is pivotal and will ultimately shape how the customer views your bank. Unfortunately, this experience cannot be offered by a conventional on-site setup and in-branch presence.

This is exactly where Evia Sign can eliminate the bottleneck, by allowing customers to complete their job by filling out a few electronic forms, adding digital signatures with authentication, and covering all security aspects.

Loan Handling

This is one of the finest ways Evia Sign can change the dynamics of digital banking and benefit both the lender and the borrower. Although each loan has a different name — personal loans, auto loans, student loans, mortgage loans, home equity loans, etc. — it all comes down to multiple approval processes and signatures from various people. Here’s how Evia Sign can enhance the loan application process.

- Save days of processing time in printing, scanning, and signing physical documents and approve loans quicker.

- Improved security — authentication can verify that the loan borrower is signing the document.

- Detailed audit trails — In-depth track of document activities and guard against tampering.

- Streamlined processes can reduce the possibility of missing signatures.

- Improved convenience — consumers may apply for loans at any time, from anywhere, using a variety of devices, without having to visit a branch, which shortens the time-consuming application process and reduces drop-off rates.

Credit card business

Credit card businesses — identified as one of the core sales processes of banks that would work well with Evia Sign and its regulated workflows. In general, this consists of two phases, one where the actual sales process occurs, finding the potential customer, and the other with a lot of admin processes in the issuance, involving approvals and a bunch of signatures where an Evia Sign’s authentication feature can serve its purpose at its fullest with overall compliance and enhanced security, allowing bank staff to stay focused on generating more credit card sales and providing competent services.

Human resources and talent management

The HR department is the backbone of any institution, especially in banks, due to the management of their significant employee count. Evia Sign can assist the HR department of banks and other financial institutions in many ways — signing off employee contracts and agreements and processing employee information and other related documents. These can be managed in simple workflows with audit trails and automated follow-up on timely signatures, saving time and energy to invest in a more human-first HR approach.

Legal matters and contract management

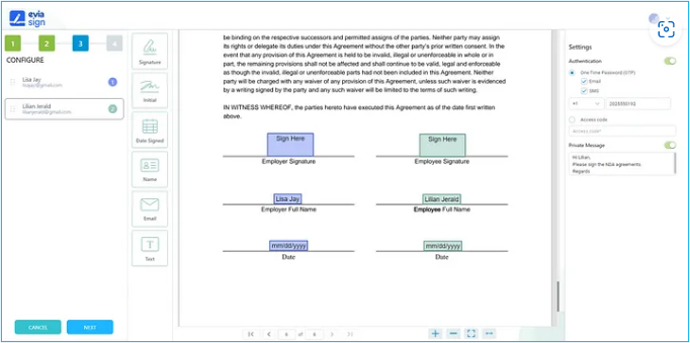

Security is the top most factor that requires extra thought when dealing with legal circumstances. Circulation of legal, confidential documents for signatures to and from relevant signatories requires security at its best. Evia Sign can unquestionably be the best option to get your hands on since the digital authentication feature only allows people with the proper authorization to view and sign the document. This can be achieved by including an OTP or access code in the signature request process, which is sent to the authorized intended parties, and anyone who opens the document for signing will always be asked to verify their identity. In addition, a thorough audit trail will also showcase all the actual actions taken on the document in real time, and a digital certificate that adheres to the AATL standard makes the document tamper-proof.

Why should your organization choose Enadoc Evia Sign?

Your customers will appreciate a modernized banking experience, and Evia Sign can effectively and sustainably assist you in delivering it. We have worked with an expert team to offer a legally binding, trustful, secure digital signature platform to support your organization’s shift to the digital age of convenience.

With Enadoc Evia Sign, you can:

- Save time and operational costs by implementing a paperless approach to sending a signature request in less than 5 minutes.

- Platform independent — Review and sign documents from any device, anywhere, at any time.

- Enhanced security — OTP and access code authentication makes sure that signatories confirm their authority before accessing and signing confidential papers.

- Meet the standards — The AATL-compliant digital certificate of Evia Sign will prevent your sensitive document from tampering.

- Track document — with thorough audit trails, you can track all the operations performed on the document in real-time.

- Save your ideal signature and initial — saving your signature and initial, you can add them to a document by simply clicking on the relevant stamp.

- Send reminders — This makes sure timely follow-up and tackles the the problem of missed signatures.

- Sign in four ways — Type, mobile, draw or upload.

What’s next?

Try Enadoc Evia Sign for FREE.

Check out how you can alleviate your banking activities.